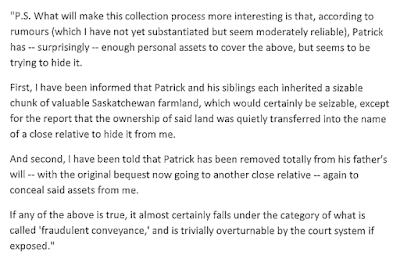

As a followup to an earlier post where I demonstrated quite clearly that, rather than accusing chick magnet and swamp thing Patrick Ross of, you know, wrongdoing, I showed how I carefully couched my discussions in numerous speculations and hypotheticals. What is amusing is that, in Patrick's Affidavit from back in November of 2022, Patrick in fact grabbed a chunk of text from a blog post of mine which (hilariously) was literally replete with exactly what I was talking about:

Patrick clearly believes he's got me with the above, while choosing to ignore the conditional/speculative nature of phrases like "according to rumours (which I have not yet substantiated ...", "I have been informed", "I have been told" and, most prominently, "If any of the above is true."

So, once again, Patrick is going to have an uphill climb claiming that I made any actual accusations. Oh, and still nothing on the "Let's get this trial moving" front.

3 comments:

Was the inherited farmland ever in his name? There would be title records of a conveyance less than 2 years before declaring bankruptcy (or after declaring). If he was named in a will, he inherits on death of whoever willed it. I think you can decline an inheritance which is a money pit with liabilities, but not in this case. That sounds like inheritance from a grand parent?

If the father changed his will before dying, then I don't see how that can be fraudulent conveyance unless there is a smoking gun of proof that whoever got his share has to give it to PR, or documentation of collusion.

In my non lawyer opinion, if a parent cuts a child out of a will, it shouldn't matter if it was because child will fritter it away or whatever. The child can sue the estate to receive their equal fraction, but he doesn't have to sue, and you cannot compel him to.

I've written on most of this before so I'm not going to go over it again, but I will address one point -- if Patrick inherited anything, he *cannot* decline any of that inheritance. For the purposes of bankruptcy and "after-acquired assets", once a party passes away, any inheritance bequeathed to an undischarged bankrupt is considered assets *immediately*; otherwise, bankrupts could simply refuse to accept anything until they were out of bankruptcy, which would be a howlingly obvious loophole.

So, at the moment, whatever Patrick was left as an inheritance *must* be declared as after-acquired assets when he eventually tries to get out of bankruptcy. If that ever happens.

Agreed that he cannot decline inheritance if it happens, as the land appears to be.

The father's will could give his share to someone else and it would out of your reach unless you can prove collusion. However, crooks lack the discipline to make this work, otherwise they would be successful in legitimate activity.

He could sue the other beneficiary to get his share. Perhaps the judge would treat it like the case in every intro to business law, where the two highwaymen were in court, one suing the other for not dividing the proceeds of their robberies as agreed.

As we all know, in that case, illustrating you can't sue for a business deal gone bad when the business is itself a crime, the judge found them guilty of robbery and hanged them both.

Post a Comment